Regional Trends in State Business Incentives Programs

To maintain a competitive edge in attracting businesses, states develop their incentive programs to build on current strengths or fill gaps in economic development. Since incentive programs are catered to the needs of each state, regions’ programs differ in structure, type, and size. The specifics of a program may ultimately be the deciding factor for a business looking to locate or relocate.

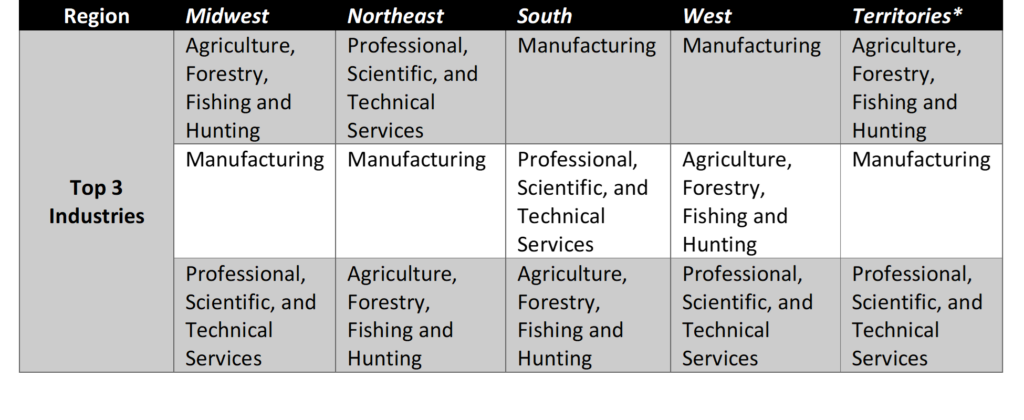

Industry specific incentive programs across the country by and large address NAICS codes 11 (agriculture, forestry, fishing, and hunting), 31-33 (manufacturing), and 54 (professional, scientific, and technical services). However, the regions where each of these three industries is most dominant varies. Table 1 below indicates the ranking of most popular industries by region.

*Equal number of programs for each of these industries

With prominent research institutions, like MIT and Harvard, in the northeast, it is no surprise that professional, scientific, and technical services far outnumber other industry-related programs. Interestingly, while the South’s most popular industry is manufacturing, each of its top 3 industries for incentives programs are roughly the same in number. In fact, its total professional, scientific, and technical services-related programs outnumber that of the Northeast. Recently, North Carolina’s Research Triangle and Atlanta’s innovation centers have attracted tech giants like Meta, Apple, Alphabet, and Microsoft.[1] Additionally, Tesla moved its headquarters to Austin, Texas just a few years ago. It is not clear if incentive programs play a part in tech’s migration to the South, but a correlation exists, nonetheless.

While technology and manufacturing incentive programs appear most prevalent in the Northeast and South, agriculture seems to play a bigger part in the West and Midwest. In the Midwest, agricultural programs are nearly double that of manufacturing, the region’s second most popular industry for incentives. Nebraska and Iowa distribute the greatest amounts of federal Farm Service Agency loans.[2] Additionally, California, Illinois, and Iowa, are the top agriculture exporting states in the country, helping to explain the popularity of agricultural incentives in the region.[3]

The next most popular industry for incentive programs is NAICS code 71 (arts, entertainment, and culture), which trails nearly 200 programs behind professional, scientific, and technical services. Incentive programs in this industry mostly cover film and theater production, sports, and tourism. The South maintains the most programs in this industry. However, the art industry is the second most prevalent for incentive programs in territories. Puerto Rico makes up half of those in tax credits and loans for film and tourism ventures.

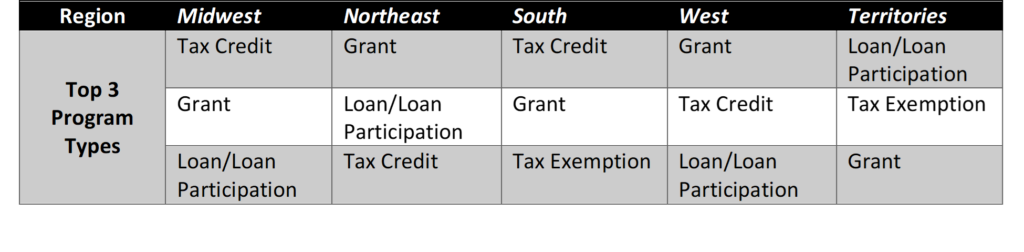

Program type is another notable area for regional analysis. Overall, the most popular types of programs in order are tax credits, grants, and then following very closely, loans. The table below breaks down the most popular program types by region.

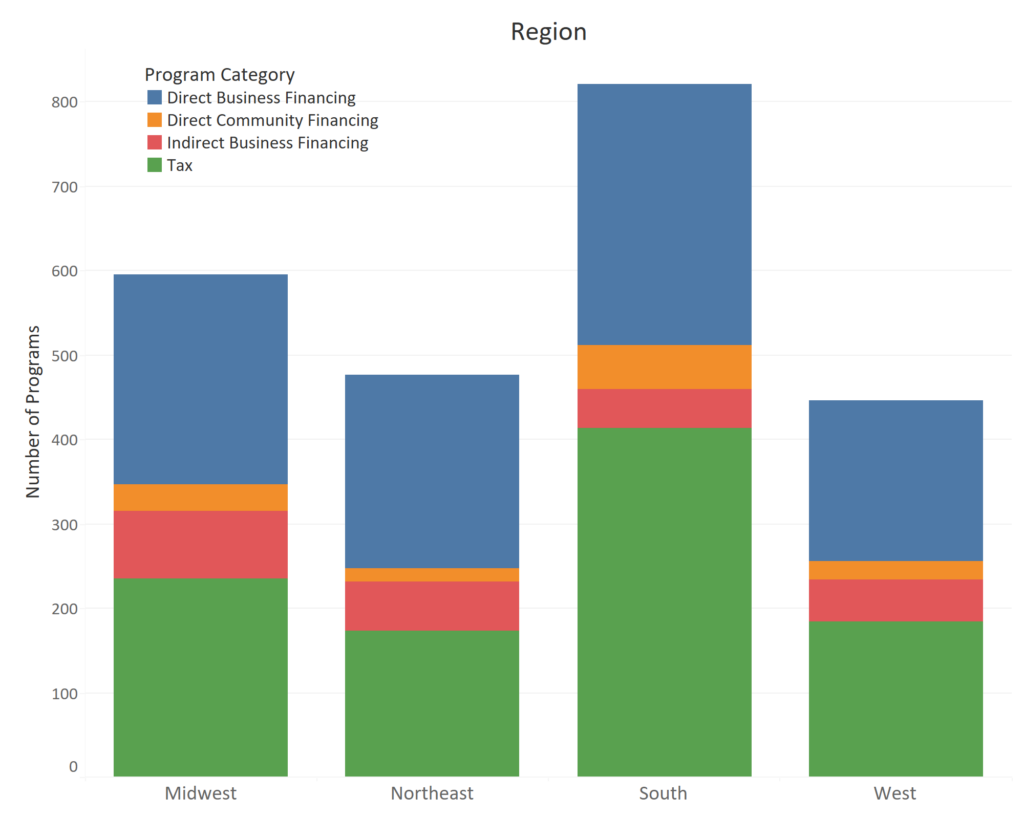

Every region, including territories, favors direct business financing programs, like grants or loans. However, the South is the only region where tax-related programs are more common. Nonetheless, tax programs are greatest in number across the whole country indicating that tax burden reduction is a common goal. The bar chart below shows the distribution of program categories by region.

The South outnumbers all other regions across every program category, besides indirect business financing. As expected, direct community financing and indirect business financing pale in comparison to tax programs and direct business financing.

The data makes it clear there is a diversity in strategy and approach for implementing business incentive programs between regions. Regions can be broken down and defined in many ways. The different ways we define a region will likely tell a unique story about regional business development priorities. Find out your region’s story by checking out C2ER’s State Business Incentives Database.

[1] Eanes, Zachary. “Meta, Other Tech Giants Flock to Raleigh and Durham.” Axios. Accessed August 9, 2023. https://www.axios.com/local/raleigh/2022/06/08/meta-possible-expansion-raleigh-north-carolina.

[2] Program data. Accessed August 9, 2023. https://www.fsa.usda.gov/programs-and-services/farm-loan-programs/program-data/index.

[3] “Annual State Agricultural Exports Interactive Chart.” USDA ERS – Annual State Agricultural Exports. Accessed August 9, 2023. https://www.ers.usda.gov/data-products/state-agricultural-trade-data/annual-state-agricultural-exports/#:~:text=The%20top%20three%20exporters%20of,soybeans%2C%20corn%2C%20and%20feeds.