New Workforce Development Programs Reflect Importance and Need for Training and Talent Development

By Chelsea Thomson

Even before the COVID-19 pandemic and social unrest, states incentivized employers to support those out of work and provide opportunities for occupational advancement, especially for marginalized communities and ones characterized by historic divestment. These programs are crucial for getting people back into the labor market and providing the opportunities for reskilling and upskilling necessary to secure a living wage. A talented pool of labor, aligned with employer needs, encourages businesses to relocate to certain areas or expand their operations. States and cities are also encouraging workers to move to their locations through creative place-making initiatives. The workforce development programs that states primarily develop and fund include skill upgrading, talent retention, pipeline development, and cluster and sector strategies. States accomplish these goals through internships, apprenticeships, youth training programs, partnerships with secondary schools, and collaboration across industry stakeholders, community-based organizations, educational institutions, and businesses.

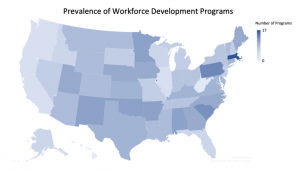

C2ER’s State Business Incentives Database tracks these initiatives and provides insight into the mechanisms states use to support employers and workers in developing the workforce necessary for economic success and mobility. Nearly all states and some territories have workforce development programs, with an average of four (4) programs per state. Several states recently added programs focused on workforce development, on top of the more than 250 programs states already implement. Massachusetts, Minnesota, North Carolina, Virginia, and Arizona all brought on new programs in the past year.

The most common focus of these workforce development programs is offering an incentive for employers to provide training by reimbursing or allowing a tax credit against the training costs. Both the Minnesota Automation Training Incentive Pilot Program and Arizona’s Rapid Employment Job Training Grant offer reimbursement for training costs. Minnesota reimburses training costs for small businesses to train existing workers in new automation technology. Employers can apply for grants up to $25,000 to cover the cost of training workers who work full time and earn at least 120% of the federal poverty wage. As a direct response to COVID, Arizona’s program reimburses the cost of training for hires made after March 1, 2020. Virginia created the Worker Training Tax Credit to incentivize businesses to not only provide training but also collaborate with middle and high schools to provide manufacturing training or instruction. Companies can receive a 35% tax credit for training costs, up to $500 per worker and $1,000 if the worker’s income is below the state median wage. For employers that provide training to middle and high school students, they are eligible for the 35% tax credit on direct training costs.

The remaining two programs focus on aspects of workforce and talent development beyond training. In Massachusetts, the Advanced Analytics-Data Science Internship Program reimburses the cost of intern stipends for students with post-secondary degrees, Bachelor’s and above, who intern with a research institution or small business. The reimbursement ranges from $20-$40/hour depending on the education level of the intern.

North Carolina’s Golden LEAF Opportunities for Work program provides grants up to $500,000 to help the state prepare for job growth, especially jobs that require post-secondary degrees. The program accomplishes this goal through re-engaging individuals in the workforce, providing skills training and post-secondary opportunities, and addressing barriers to employment in rural and economically distressed communities. The program targets “disconnected” youth, people who are underemployed, and those experiencing long term unemployment.

These five innovative programs are a small slice of the workforce development picture in the U.S., but they provide insight into the mechanisms states use to stimulate talent development and training. As states respond to the impacts of the COVID-19 pandemic and grapple with calls to address the systemic barriers marginalized communities face, the type, focus, and benefit of workforce development programs will become all the more important.