SSBCI 2.0’s Implementation across States and Other Jurisdictions

Introduction

With the passage of the American Rescue Plan in 2021, Congress reauthorized the State Small Business Credit Initiative (SSBCI 2.0) with an allocation of $10 billion to improve access to capital for underserved small businesses and entrepreneurs. The Department of Treasury (“Treasury”) administers the program and oversaw a first round (SSBCI 1.0) from 2010 and 2017, passed as part of the Small Business Jobs Act of 2010, that offered $1.7 billion in funding in the wake of the financial crisis. It estimated that by 2016 SSBCI 1.0 had leveraged $8.95 in new private financing for every $1 in funding. Given this success, Congress reinstated and expanded the program with the onset of the pandemic and the ensuing economic fallout. SSBCI 2.0 funding is now flowing to states, the District of Columbia, territories, and tribal governments to support small businesses and entrepreneurs across the country.

SSBCI 2.0’s Budget Allocations[1]

Congress allocated SSBCI 2.0’s $10 billion to the following purposes:

- $6.0 billion to states, the District of Columbia, and territories (jurisdictions) to support small businesses

- $500 million to Tribal governments to support small businesses

- $1.5 billion for small businesses operated by socially and economically disadvantaged individuals (SEDI-owned business)

- $1.0 billion for an incentive allocation for participants that demonstrate robust support for SEDI-owned businesses

- $500 million for very small businesses (VSBs)

- $500 million for technical assistance funding

The geographic allocation of the funding for jurisdictions is complicated with most funds going to jurisdictions based on their population size and then a smaller portion set aside based on the prevalence of SEDI-owned businesses (measured as the percentage of the jurisdiction’s population residing in Community Development Financial Institution (CDFI) Investment Areas). Treasury releases the funding to each jurisdiction in three tranches with the first arriving upon the approval of its application and the second and third following certification that it deployed 80% of the preceding tranche.

SSBCI 2.0’s Programs[2]

SSBCI 2.0 aims to increase small businesses’ access to capital using private lenders by utilizing a wide range of programs. Its programming is divided into two components – credit programs and equity (i.e., venture capital) programs. For both, Treasury disburses the money to tribes and jurisdictions to design their own programs to address their regional economic development challenges and goals.

Tribes and jurisdictions typically utilize one or a combination of the following six programs:

- Capital Access Program (CAP) – provides portfolio insurance in the form of a loan loss reserve fund into which the lender and borrower contribute.

- Collateral Support Program – provides cash collateral to augment a small business’ collateral.

- Loan Guarantee Program – offers partial guarantees for private loans to improve lender confidence in extending credit.

- Loan Participation Program – provides credit support through the purchase of a portion of a loan made by a lender or through a direct comparison loan provided alongside a loan provided by a private lender.

- Equity Capital Program (Direct) – provides capital in the form of equity investments directly to small businesses alongside co-investments.

- Equity Capital Program (Funds) – provides capital to venture capital funds that invest in small businesses.

Treasury also manages a Technical Assistance Program that provides funding to tribes, jurisdictions, and other entities for the support of legal, accounting, or financial advisory technical assistance to small businesses.

Preferred Programs

Over two years since the American Rescue Plan’s passage, all tribes and jurisdictions have submitted their applications and Treasury is in the process of reviewing them and distributing the first tranche of funding. Many tribal applications are still being reviewed so this data highlights each jurisdiction’s capital programs and allocation spending requests which presents an opportunity to analyze which programs they are employing to support small business growth. [3]

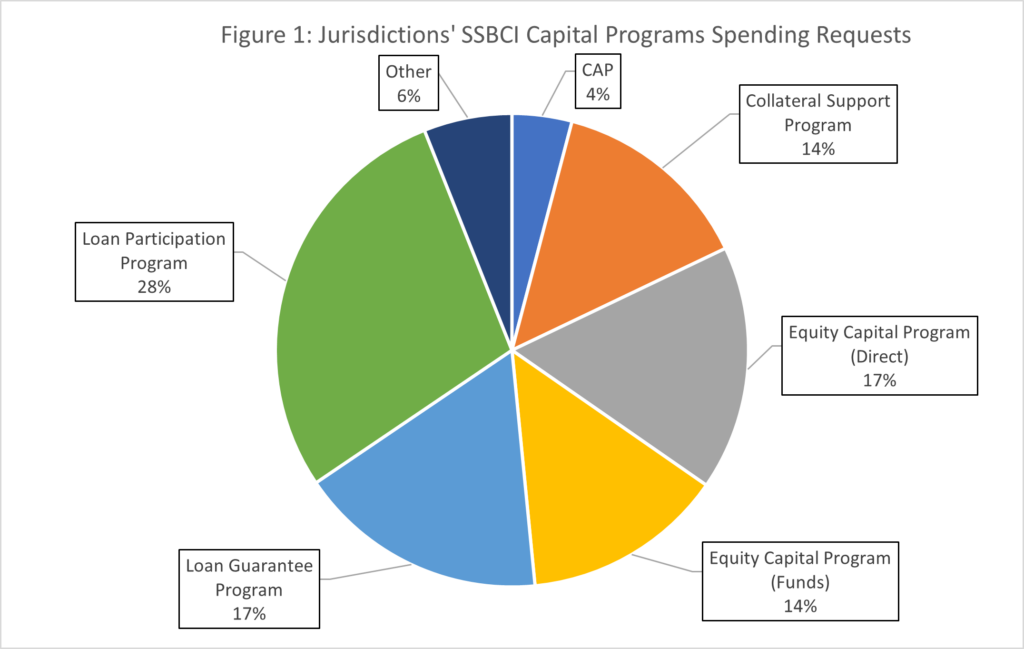

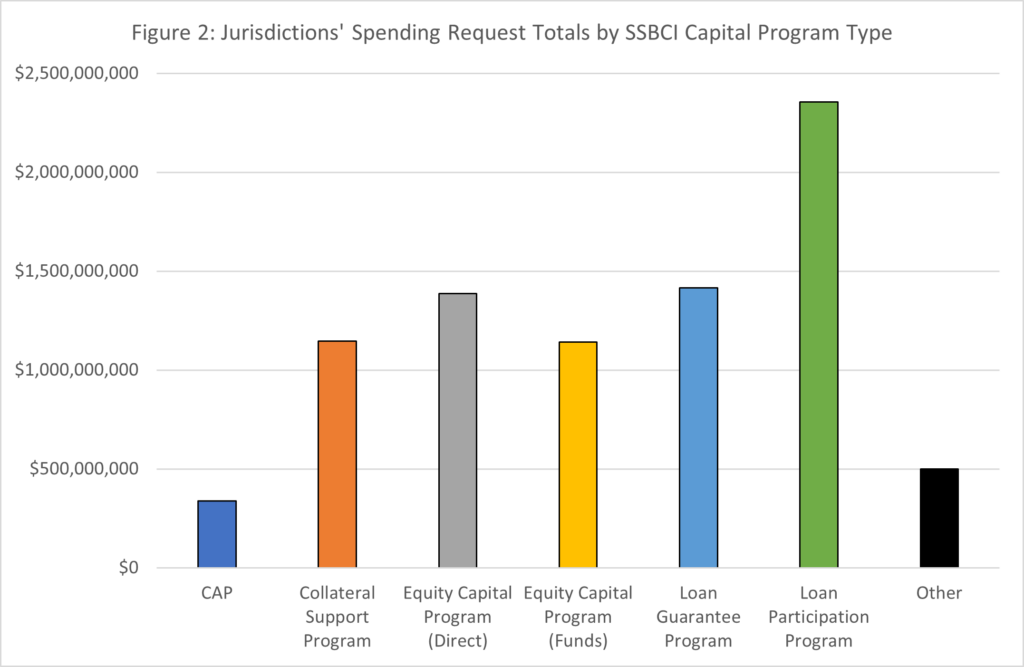

Figures 1 and 2 illustrate how jurisdictions will allocate their SSBCI 2.0 capital funding as of summer 2023. Figure 1 reveals that loan participation programs received the greatest percentage of funding (28%). Loan guarantee (17%), direct equity/debt hybrid capital (17%), collateral support (14%), and fund equity capital (14%) programs all received roughly similar percentages. Although capital access programs (CAP) received the least funding (4%), CAP transactions require the least funding to operate and were the most common transaction for several states and nationally as part of SSBCI 1.0. Figure 2 translates these percentages to dollar amounts. As of June 2023, states and territories have requested over $8 billion for their capital programs. Of this total, loan participation programs received roughly $2.35 billion. Loan guarantee, direct equity/debt hybrid capital, collateral support, and fund equity capital programs all fell between $1.42 and $1.14 billion. Collateral access programs only totaled approximately $339 million. These allocation totals will change as jurisdictions modify their programs with approval from Treasury.

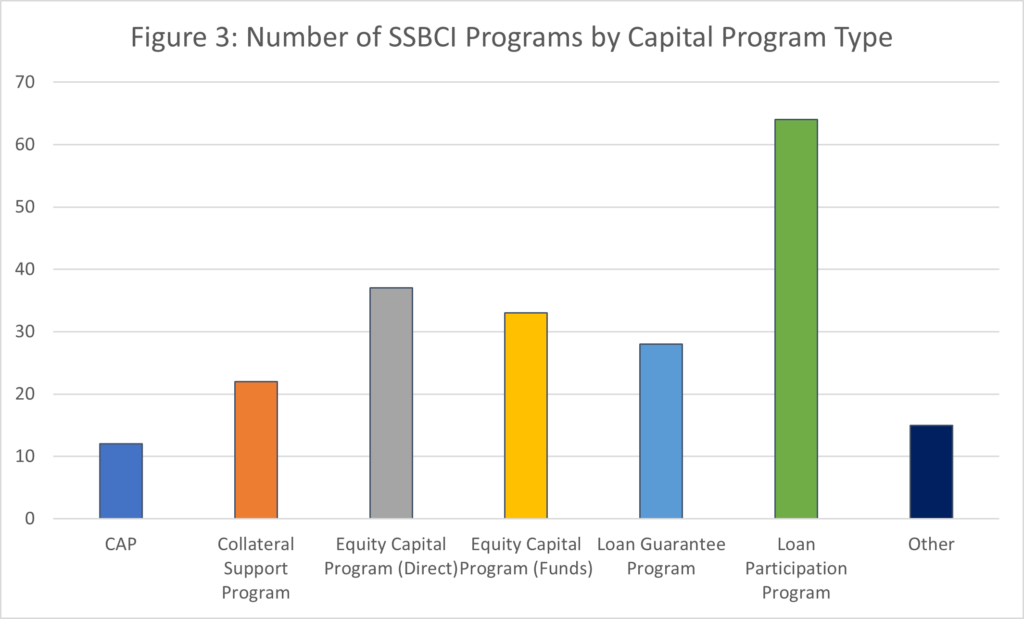

Figure 3 counts the total number of programs for each of the six program types among jurisdictions. Some jurisdictions utilize the same program type multiple times to serve different purposes and businesses. There are 64 loan participation programs, 37 direct equity/debt hybrid capital programs, 33 fund equity capital programs, 28 loan guarantee programs, 22 collateral support programs, 12 capital access programs, and 15 other programs.

New York[4]

New York State’s population and economy maintain strong regional variations. The city is the most ethnically diverse in the country and is home to numerous industries such as finance, software, real estate, and restaurants. Upstate holds medium-sized cities and towns where agriculture and manufacturing largely make up local economies. Empire State Development, New York’s state economic development agency, utilized its SSBCI 2.0 funding through several of the aforementioned capital program types to support small business growth and to advance the state’s economy across its distinct geographies, industries, and peoples. Some of these programs include:

New York’s Capital Access Program provides $29.4 million in portfolio insurance to cover participating lenders to increase financing for SEDI business owners and very small businesses.

The Capital Project Loan Fund is a loan participation program that offers $106 million for direct loans mainly to manufacturing businesses. This funding aids businesses in acquiring, renovating, and constructing buildings or in purchasing machinery and equipment.

The New York Forward Loan Fund II is another loan participation program that Empire State Development expanded with SSBCI funds that works with nonprofit lenders to deliver $150 million in funding to support small businesses and nonprofits. They can apply for loans of up to $150,000 at fixed interest rates to cover a variety of expenses such as equipment, payroll, utilities, rent, marketing, building renovations, and more. The program also offers free support through the state’s network of Entrepreneurship Assistance Centers that provide instruction, training, technical assistance, and support services. Prior to its expansion, the Forward Loan Fund II had a strong track-record as 1,700 loans went to small businesses, 63% of the funds went to businesses owned by women and people of color, and 90% of loans went to businesses and nonprofits with fewer than ten employees.[5]

The Emerging and Regional Partner Program Fund is an equity capital fund program that provides $102 million to fund managers who are early in their careers, from diverse backgrounds, or seeking to invest in areas of New York State where venture capital is less available. These managers must also target their investments in technology and high growth-oriented industries such as life sciences, advanced manufacturing, and information technology.

New York Ventures is a direct equity/debt hybrid capital program that the state expanded with SSBCI 2.0 funding and now offers $135 million to support the state’s startup ecosystem. The program targets entrepreneurs from diverse backgrounds with early-stage companies who are working in sectors such as climate technology, health tech and life sciences, ag-tech, advanced manufacturing, SaaS, data, and AI. Since its inception, the program has supported 195 companies (60% located outside of New York City), garnered $350 million in matching investments from the private sector, and made 40.5% of its investments in companies started or led by women or minority groups.[6]

New York State assists contractors through two loan guarantee programs. Empire State Development manages the Surety Bond Assistance Program which offers technical assistance and $22 million to help contractors secure a surety bond line, a bid bond, or a payment bond on publicly funded or government-led projects. The Contractor Financing Program also carries $22 million in funding and is run through financial intermediaries to increase contractors’ access to capital so that they can ease the timing of payments when doing work for public agencies, municipalities, SEDI-business owners, and owners in distressed areas. Contractors can use the loan flexibly to cover expenses such as advances against inventory, purchases orders, and construction costs. Both programs target small contractors by setting an upper limit of $5 million and, in the case of the latter, a limit of no more than 100 employees.

New York State’s use of SSBCI 2.0 funds through several capital program types enables it to support a wide range of sectors, populations, and geographies that reflect its heterogeneity. These sectors range from manufacturing to building to life science to AI. Throughout, the focus on small businesses is central and the funding is regularly targeted to startups or businesses with less than $500 million in revenue and fewer than 500 employees. These programs also aid groups that society and the economy have historically excluded such as women and minorities. Finally, many of the programs aim to support regions where capital is scarce, often far outside of New York City such as Upstate New York. New York State thus demonstrates how other states can leverage SSBCI funds and utilize an array of capital programs to reach the different niches of their economies to generate inclusive economic growth.

California

California received an allocation of $1.2 billion in SSBCI 2.0 funds and currently runs four programs through two state agencies. The California Infrastructure and Economic Development Bank (IBank) manages two programs: The Small Business Loan Guarantee Program began in 1968 and the state expanded it with approximately $391 million in SSBCI funding to encourage lenders to provide financing to small businesses that experience barriers to accessing capital typically located in low- to moderate-income communities.[7] The Expanding Venture Capital Access Program carries $200 million in funding to attempt to create a more inclusive venture capital ecosystem by supporting underrepresented venture capital managers and by investing in underrepresented entrepreneurs and business owners and geographic areas that are socio-economically disadvantaged. The program also seeks to promote climate equity and justice through its investments.[8] The California Pollution Control Financing Authority (CPCFA) oversees two additional programs: CalCAP for Small Business is a capital access program that incentivizes financial institutions to lend to small businesses. Loans can total up to $5,000,000 and small businesses with up to 500 employees may use the funding for working capital, capital projects, start-up costs, land acquisition, construction, or renovation of buildings.[9] CalCAP Collateral Support encourages financial institutions to evaluate small businesses on factors other than collateral by pledging cash to cover collateral shortfalls for loans. CPCFA supports loans to businesses with up to 750 employees and the loan amounts vary by sector with a maximum of $20 million. Businesses may use the loans for the same purposes as the CalCAP for Small Businesses program.[10] Together, these four programs will strengthen and expand California’s small businesses and venture capital environment.

Florida

Florida collected $488 million in SSBCI funding that the Department of Economic Opportunity and Enterprise Florida, Inc. jointly administer through five programs. These programs are less distinct or targeted than New York or California’s programs but include a collateral support program, a venture capital program which is structured as a direct equity/debt hybrid capital program, a loan participation program, a loan guarantee program, and a capital access program. Businesses with less than 500 employees may apply and they can use funding for start-up costs, business procurement, franchise fees, equipment, inventory, and the purchase, construction, renovation, or tenant improvements.[11]

[1] Dilger, Driessen, and Levin, “State Small Business Credit Initiative: Implementation and Funding Issues.”

[2] U.S. Department of Treasury, “State Small Business Credit Initiative Fact Sheet.”

[3] U.S. Department of Treasury, “State Small Business Credit Initiative Fact Sheet.”

[4] “Empire State Development | State Small Business Credit Initiative (SSBCI).”

[5] “Empire State Development | New York Forward Loan Fund.”

[6] “Empire State Development | Venture Capital .”

[7] “Loan Guarantees | California Infrastructure and Economic Development Bank (IBank).”

[8] “Venture Capital Program | California Infrastructure and Economic Development Bank (IBank).”

[9] “CPCFA CalCAP for Small Business.”

[10] “CPCFA CalCAP Collateral Support Program.”

[11] “SSBCI – FloridaJobs.Org.”

Sources Cited

California Infrastructure and Economic Development Bank (IBank). “Loan Guarantees | California Infrastructure and Economic Development Bank (IBank).” Accessed August 9, 2023. https://ibank.ca.gov/small-business/loan-guarantees/.

California Infrastructure and Economic Development Bank (IBank). “Venture Capital Program | California Infrastructure and Economic Development Bank (IBank).” Accessed August 9, 2023. https://ibank.ca.gov/small-business/venture-capital-program/.

California State Treasurer’s Office. “CPCFA CalCAP Collateral Support Program.” Accessed August 9, 2023. https://www.treasurer.ca.gov/cpcfa/calcap/collateral/index.asp.

California State Treasurer’s Office. “CPCFA CalCAP for Small Business.” Accessed August 9, 2023. https://www.treasurer.ca.gov/cpcfa/calcap/sb/index.asp.

Dilger, Robert Jay, Grant Driessen, and Adam Levin. “State Small Business Credit Initiative: Implementation and Funding Issues.” Washington, D.C.: Congressional Research Service, July 25, 2022. https://crsreports.congress.gov/product/pdf/R/R42581.

Empire State Development. “Empire State Development | New York Forward Loan Fund,” June 6, 2023. https://nyloanfund.com/.

Empire State Development. “Empire State Development | State Small Business Credit Initiative (SSBCI),” August 9, 2022. https://esd.ny.gov/ssbci.

Empire State Development. “Empire State Development | Venture Capital ,” June 2, 2021. https://esd.ny.gov/venture-capital.

Florida Commerce. “SSBCI – FloridaJobs.Org.” Accessed August 9, 2023. https://floridajobs.org/FloridaSSBCI.

U.S. Department of Treasury. “State Small Business Credit Initiative Fact Sheet.” Washington, D.C.: U.S. Department of Treasury, June 2023. https://home.treasury.gov/system/files/256/State-Small-Business-Credit-Initiative-SSBCI-Fact-Sheet.pdf.