Getting to Work[force]: State Business Incentive Database Summer 2022 Update

Workforce development has become a hallmark of community economic development, and the term encompasses the activities, policies, and programs that work to connect occupational skills and vocational training services with the economy’s actual need for workers. There are many strategies that states and regions employ to develop and maintain a skilled workforce, but the State Business Incentive Database that is maintained by the Center for Community and Economic Research (C2ER) specifically tracks programs that focus on the education, training, and recruitment of workers, especially those that concentrate on improving the skill base and job placement of the state’s labor base. Research suggests that aligning economic development programs and policies with community priorities will create initiatives that are more “people-centric and place conscious.[1]” Evaluating the specific focus on workforce development programs across the nation allows for a better understanding of whom these programs serve and how they may best-serve their communities.

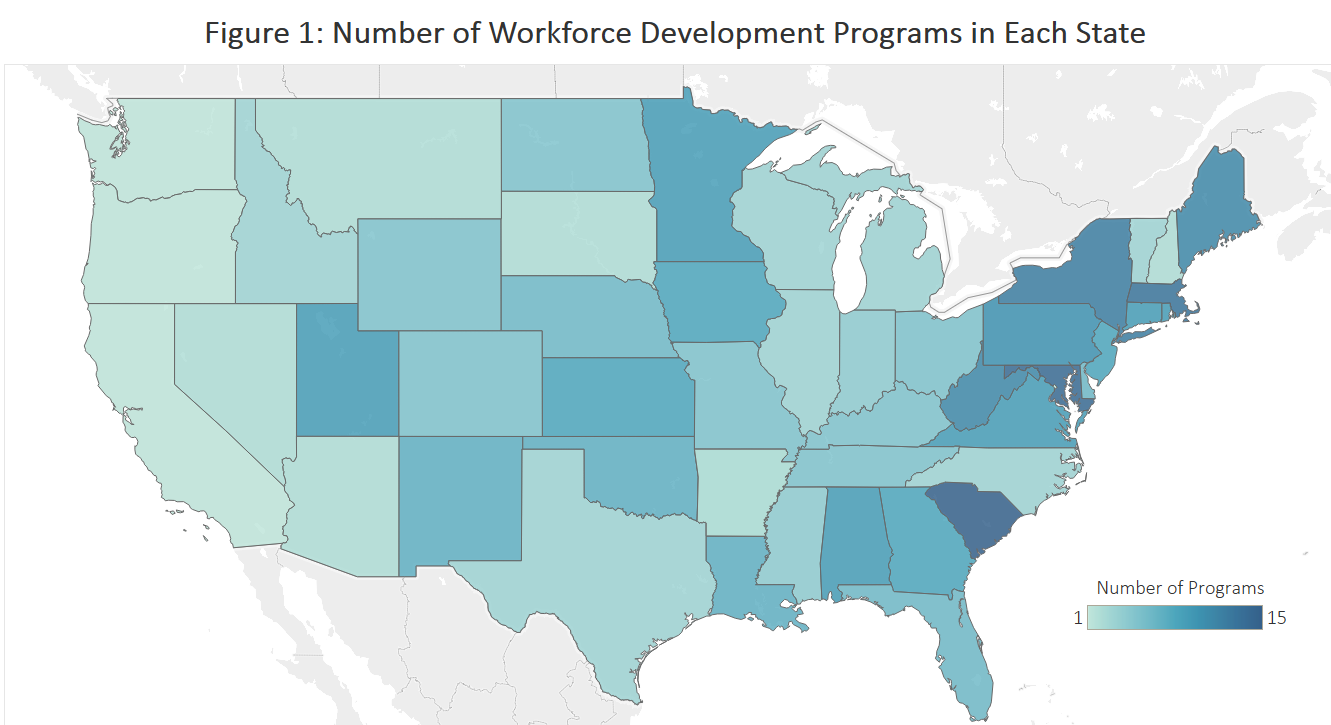

Figure 1 shows where workforce development incentives are most and least prevalent, with states that are more darkly shaded indicating a greater number of programs and states that are more lightly shaded indicating only a couple of programs. The map shows that most programs regarding workforce development are found east of the Mississippi river, especially in the northeast region of the United States. However, the states that have the greatest number of workforce development incentives are not necessarily those that are among the most populated states.

For example, South Carolina has the greatest number of workforce development programs but does not rank among the most populated states. Maine is also among the top five states regarding the number of workforce development programs and is one of the least-populated states.

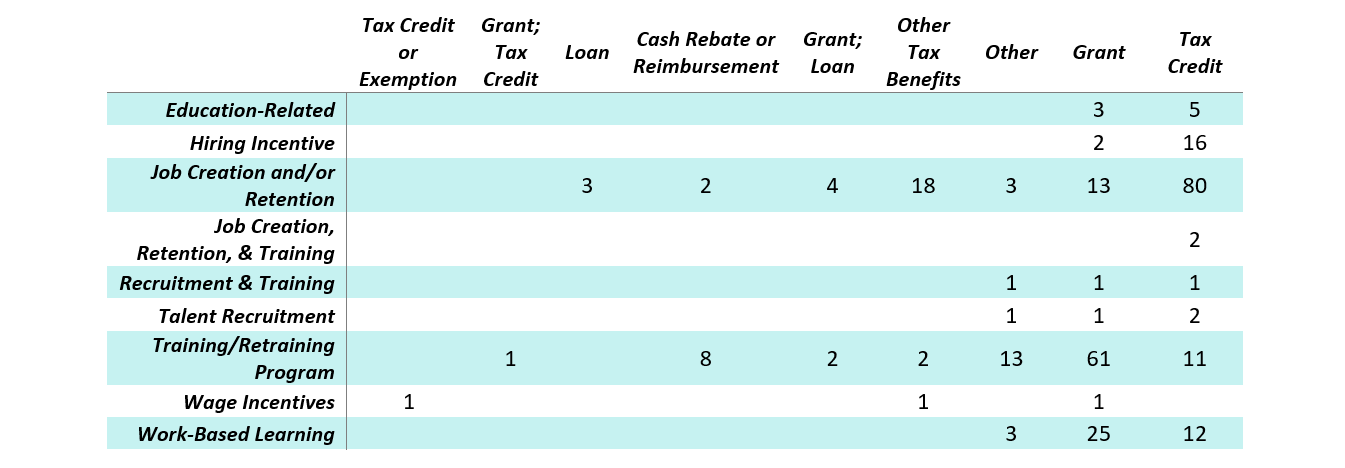

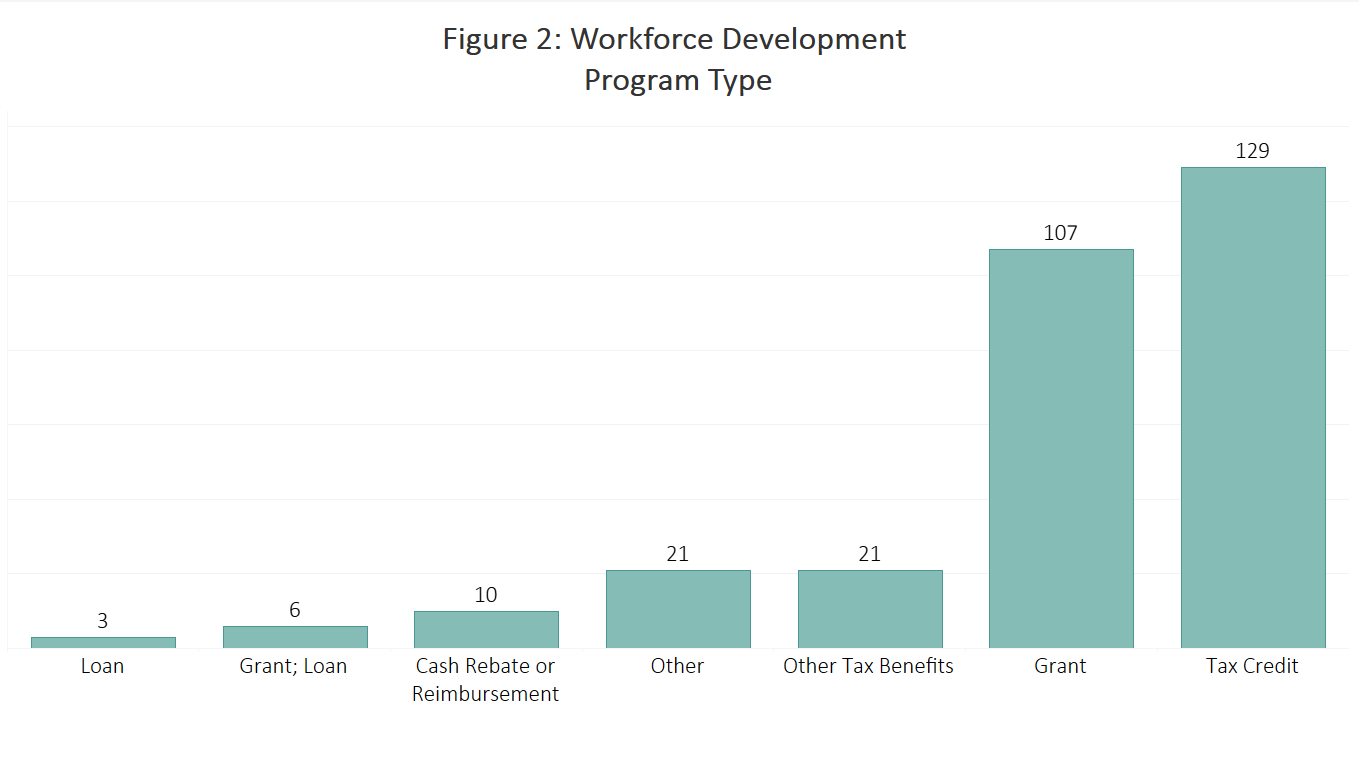

In addition to tracking incentives based on geographic area, C2ER further refines incentives by program type. There are several program types that range from grants to loans to different tax benefit, such as abatements, exemptions, refunds, and credits. The graph below illustrates that programs pertaining to workforce development are overwhelmingly grants and tax credits, meaning that most states are either providing cash to a beneficiary without the expectation of being repaid or allowing qualifying taxpayers to subtract a certain amount from the total they owe the state.

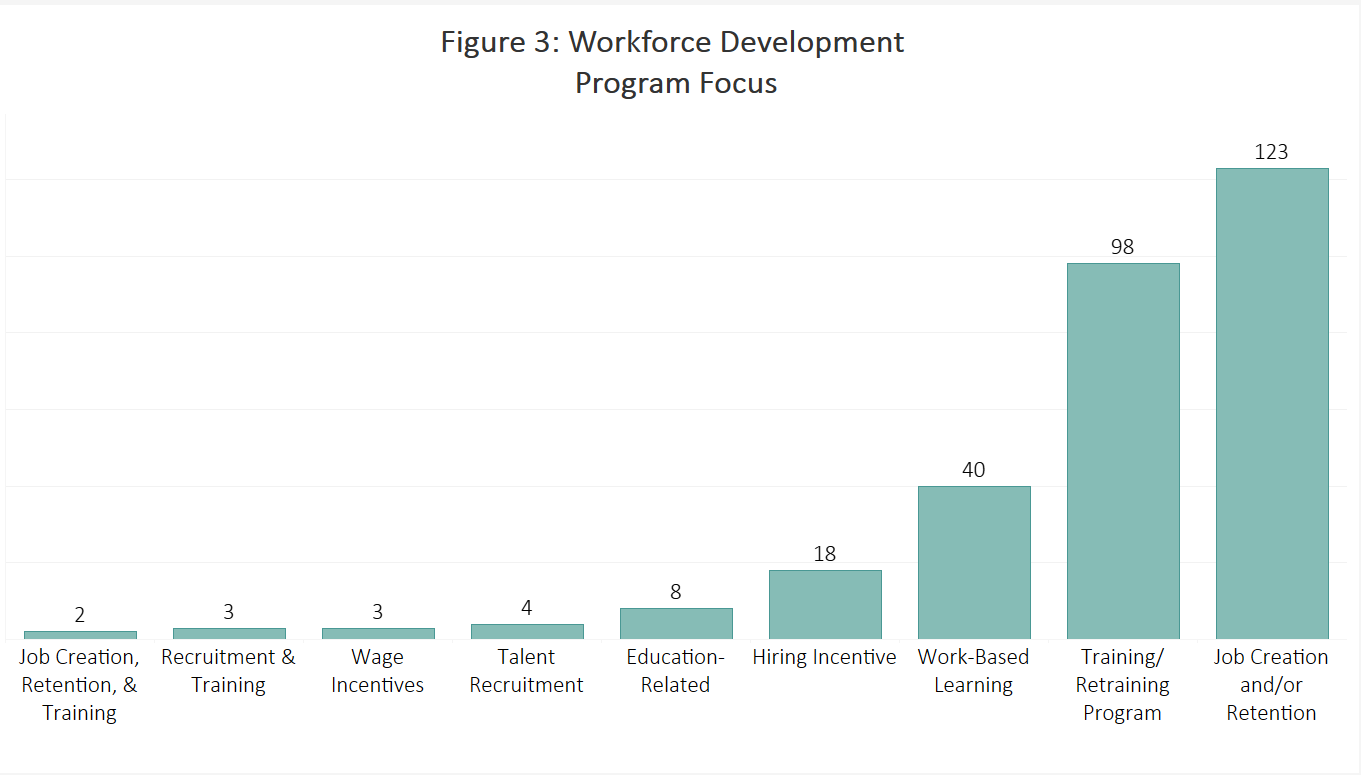

States utilize many different strategies for building and maintaining a skilled workforce, and, one approach is a problem-focused approach that works to address issues such as low-skilled workers or the need for more employees in a particular industry. Some states offer incentives for employers that create and/or retain jobs. West Virginia’s High-Wage Job Credit provides a payroll incentive for businesses to create new high-wage jobs, those in which the salary is 2.25 times that of the state median salary. Other states have programs incentivizing hiring specific groups, such as veterans. There are also workforce development programs that focus either on skills training or retraining or work-based learning, which would be apprenticeships, internships, and other “on-the-job” training programs. Figure 3 shows that most state workforce development incentives take a more problem-focused approach, as most programs can either be classified as focusing on job creation or the training of workers.

The way each state incentivizes these outcomes is also varied, as the table below demonstrates. Programs that involve worker training or work-based training are primarily grants, while programs that regard job creation or the hiring of workers are predominantly tax credits.

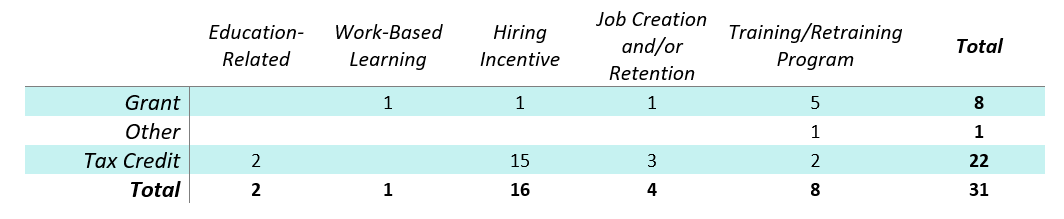

There is a more holistic approach to workforce development that considers the participants’ many barriers to the workforce and the overall needs of the region, and this solution is part of the framework that Dr. Harpel and Dr. Hackler promote in their 2020 report for more responsive economic development efforts. The graph below shows that, of the nearly 300 programs regarding workforce development, only 31 seek to address individual barriers to employment, such as having a disability, criminal history, history of substance abuse.

Of these programs that address individual barriers, most are hiring incentives that provide tax credits for employers that employ a person for a targeted group. Utah has two such incentives. One is the Veteran Employment Tax Credit, and the other is the Homeless Hiring Tax Credit. New York also has two hiring incentives for businesses that hire individuals with disabilities or an individual in recovery from a substance abuse disorder.

There is also a New Jersey program that maybe best highlights this type of holistic approach that is necessary for responsive economic development programs that help communities grow and thrive. The state’s Opioid Recovery Grant Program seeks to deepen the network of employment support available for those affected by the opioid epidemic by working to improve opportunities and incentives for opioid-impacted individuals. This New Jersey workforce development initiative aims to accomplish this by providing basic skills instruction and work experience to emphasize re-entry into the workplace as well as offering support services such as transportation, childcare, clothing, and driver’s license restoration to help facilitate the effective transition by this targeted population into employment.

Looking forward, it will be interesting to see if more states move toward this more holistic approach to workforce development programs instead of just focusing on tax credits for more jobs. Analyzing the needs of residents can help the states create more meaningful incentives for businesses to participate in the development of the workforce and improvement of communities.

[1] Hackler, Darren and Ellen Harpel. (2020). Reflecting on community priorities in economic development practices. Smart Incentives. https://smartincentives.org/wp-content/uploads/33591_SmartIncentives_Report.pdf.