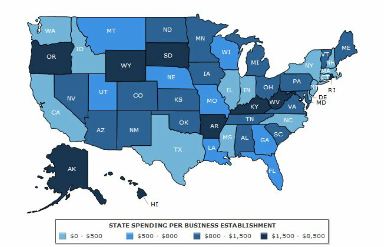

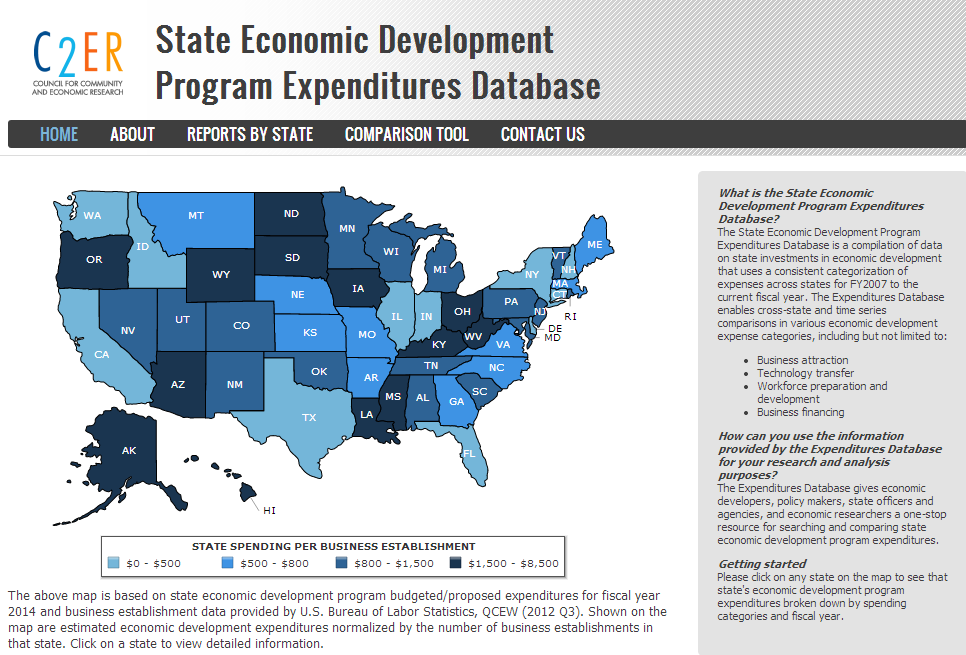

The Council for Community and Economic Research (C2ER) has updated its State Economic Development Program Expenditures Database as part of a continuous effort to track investments in economic development across all fifty states. The database now includes all Governor Recommended Budgets for fiscal year 2016. Read the full report on this update here. According to […]

Continue Reading

C2ER staffers are busy digging through the newest proposed state budgets for FY2016. As we update the State Economic Development Program Expenditures Database, a number of programs have stood out. The proposed budgets include new programs as well as some major funding increases in economic development financing, infrastructure and construction, research and development, and employment […]

Continue Reading

Beginning in 2017, those interested in incentives and tax abatement expenditures spending will likely have access to significantly more data than is currently available. The Governmental Accounting Standards Board (GASB), the independent organization which “establishes financial accounting and reporting standards for state and local governments,” is asking for public comments on a proposed change to current standards for property and tax abatement agreements.

Continue Reading

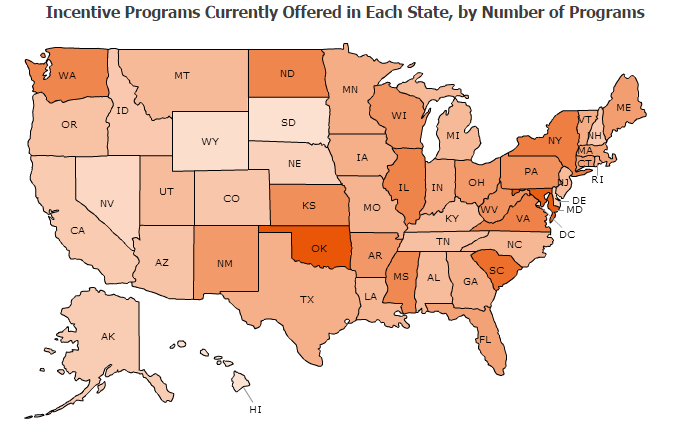

The Council for Community and Economic Research has launched the newest iteration of the State Business Incentives Database website. New features make finding up-to-date information on state incentive programs even easier for economic developers, business development finance professionals, economic researchers, and other users.

Continue Reading

A recently released report from the Brookings Institute highlights the most promising ways they believe cities, states, and regions can move forward in attracting businesses and creating jobs in a responsible and fair way. The study also confirms analysis done by C2ER of the State Business Incentives Database.

Continue Reading

C2ER has just finished its latest update of the State Business Incentives Database. This makes the State Business Incentives Database even more valuable to users who need the most up-to-date information on state programs.

Continue Reading

Data is one of the key elements of the Smart Incentives 4×4 framework that enables communities to make sound investment decisions. Unfortunately, good data on how well incentive programs work is often lacking. This lack of data hinders both economic development professionals in their day-to-day work and policymakers in their leadership and oversight roles.

Continue Reading

An old shoe factory in St. Paul is transformed into an LEED-certified affordable housing structure. Across the river in Minneapolis a disused library building becomes a neighborhood career and technology center. These are just two of the projects benefiting from the Minnesota Historic Structure Rehabilitation State Tax Credit.

Continue Reading

Sarah Jane Maxted from the U.S. Cluster Mapping Project discusses an upcoming training class, Cluster Mapping for Economic Development.

Continue Reading