Incentivizing Equity

There has been increasing support for expanding diversity, improving equity, and overall growing inclusion throughout the United States. With the conclusion of the State Business Incentives Database summer update, we can review current trends in programs supporting this movement. Moreover, we can further categorize how these programs interact with disadvantaged communities. Some programs, such as Connecticut’s Minority Business Revolving Loan Fund, specifically cater only towards minority, women, and disabled populations. Others, like Colorado’s Energize Colorado Gap Fund, give priority when applying for the differing types of incentives to disadvantaged populations. Further, diversity, equity, and inclusion (DEI) programs appear to be following the greater state incentive trend of moving towards direct business financing and away from tax incentive programs, but the overall number of them is comparatively low, making shorter term trends more difficult to discern.

There has been increasing support for expanding diversity, improving equity, and overall growing inclusion throughout the United States. With the conclusion of the State Business Incentives Database summer update, we can review current trends in programs supporting this movement. Moreover, we can further categorize how these programs interact with disadvantaged communities. Some programs, such as Connecticut’s Minority Business Revolving Loan Fund, specifically cater only towards minority, women, and disabled populations. Others, like Colorado’s Energize Colorado Gap Fund, give priority when applying for the differing types of incentives to disadvantaged populations. Further, diversity, equity, and inclusion (DEI) programs appear to be following the greater state incentive trend of moving towards direct business financing and away from tax incentive programs, but the overall number of them is comparatively low, making shorter term trends more difficult to discern.

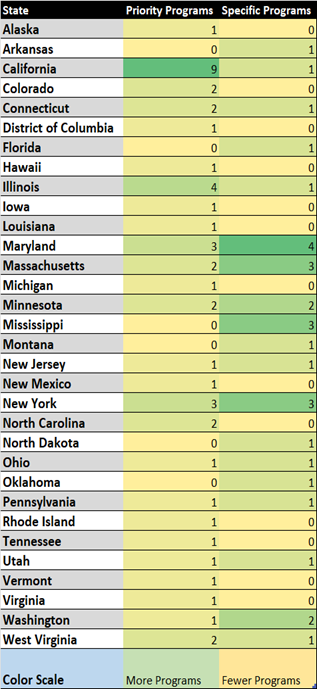

Out of the 2,354 state incentive programs counted in this summer update, 77 of them can be considered DEI programs that explicitly impact disadvantaged populations of interest. Maryland has the highest number of programs designed specifically for disadvantaged populations, at four. In general, only half of the states with DEI programs have more than one, and 61% of these programs give priority to disadvantaged.

Of the 77 DEI programs, 37 of them address minority persons or minority-owned businesses, 20 programs address disabled persons or disabled-owned businesses, and 16 of them address veterans or veteran-owned businesses. There is some overlap between these programs such as Connecticut’s Small Business Express program which, among its priorities, targets investments to support women, minority, veteran, and disabled business owners. Another program of interest is the Maryland Offshore Wind Workforce Training Program which seeks to support new or existing workforce training centers entering the offshore wind industry through grant funding. This program is aimed at supporting minority-, disabled-, and veteran-owned businesses and is one of two programs that supports currently incarcerated and individuals returning to public life from incarceration. The remainder of these programs do not specify these populations but are instead generally focused on “disadvantaged” persons, businesses, or communities.

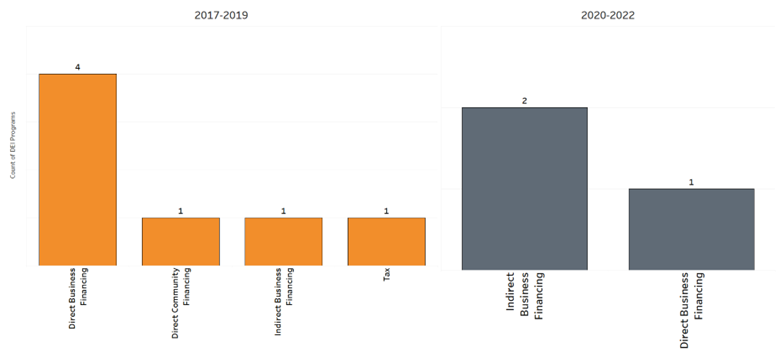

An analysis of general state incentive trends found that half of the incentive programs created from 2017-2019 were tax incentives and that only around a third were direct business financing. This distribution shifted in the following three years as tax incentives shrank to only 25% and direct business financing grew to 56%. Between 1974 and 2016, DEI programs had been added at a rate of around one program per year, however between 2017 and 2019 there were seven programs added and between 2020 to 2022 there have been another three. These programs mostly consist of business financing, with half of them being direct business financing, and only one being tax related, being the Empire State Apprenticeship Tax Credit in New York in 2018. While it is difficult to ascertain trends from due to the low number, there was only one tax program added pre-pandemic and none so far afterwards. All DEI incentives since then have been some type of financing. This follows the general trends found of state programs pivoting away from tax-based incentives and towards financing businesses

DEI programs come in many forms and are found in most states. With the economic impact brought about by COVID-19, state business incentives have seen a shift towards direct business financing and DEI programs play only a small part in this movement. This small part, however, goes a long way to supporting the economic development and growth of disadvantaged communities and persons.