Regional Trends in Southern State Business Incentives Programs

C2ER is in the process of completing its annual summer update of the State Business Incentives Database. The C2ER State Business Incentives Database provides users with data on 2,100 state business incentive programs from all US states and territories. Through a regional analysis of incentive programs in the Southern US, we can understand how geography and regional competition shapes trends in incentives programs.

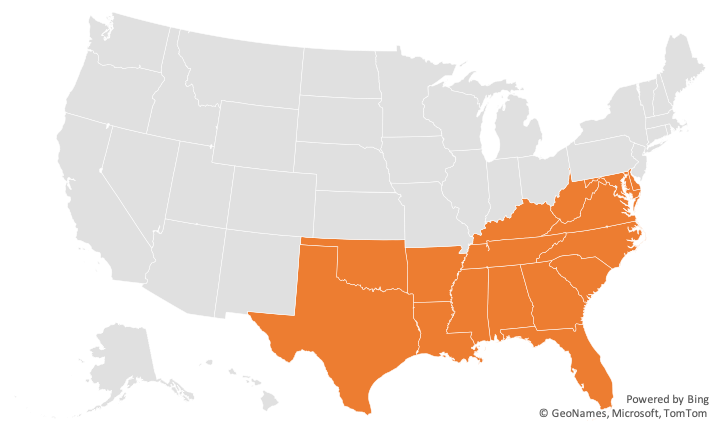

Southern States Included in Analysis

Program Business Needs

| Business Need | Southern States | National |

| Business Management | 2.8% | 7.8% |

| Capital Access or Formation | 26.1% | 75.8% |

| Facility/Site Location | 11% | 32.7% |

| Infrastructure Improvement | 10.3% | 21.3% |

| Marketing & Sales Assistance | 1.7% | 6.6% |

| Product & Process Improvement | 6.8% | 21.9% |

| Professional Networking | 0.8% | 3.1% |

| Tax/Regulatory Burden Reduction | 27.5% | 71.2% |

| Tech & Product Development | 4.9% | 14.2% |

| Workforce Prep and Development | 7.3% | 19.3% |

| Other | 0.7% | 2.8% |

Program business needs in the South generally reflect national trends, with the most programs categorized as capital access or formation programs, facility/site location, and tax/regulatory burden reduction. There are a significant number of programs that also fall under the infrastructure improvement category.

In general, national programs top business needs include capital access or formation, tax/regulatory burden reduction, and facility/site location. For Southern states, we also see infrastructure improvement as a business need that many incentive programs fall into.

Southern states’ business incentives packages typically include historic rehabilitation tax credits, grants and loans for rural development, and tax credits for manufacturing. Businesses rehabilitating properties listed on the National Register of Historic Places qualify for a 20% federal-income tax credit on qualified expenditures. On top of the federal tax credit, every Southern state offers an additional state-income tax credit between for rehabilitation, with 8 states offering a 25% tax credit. Delaware further offers a 30% tax credit for qualified rehabilitation costs for non-profits, and Kentucky offers a 30% credit for owner-occupied residential properties. Almost 40% of historic places are in the South.

Incentives in the Southern states also focus on encouraging business expansion and relocation through targeted incentives for job creation. Headquarters relocation incentives offer credits against corporations’ state tax liability to offset costs associated with the relocation of a company’s headquarters to the state, including moving and the purchase or replacement of equipment. Georgia’s Quality Jobs Tax Credit provides a state-income tax credit of up to $5,000 per new job that pays over the average state wage. Oklahoma’s Quality Jobs Program provides a cash rebate of equivalent to 5% of payroll for 10 years for businesses that expand and create new jobs in the state. These programs are designed to create high-paying jobs and increase investment in the state through offsetting the costs associated with relocation and job creation.

Southern states commonly offer incentives programs to support defense communities that host military installations, service members, and their families or are suffering from the recent closure of an installing. With a large concentration of military bases located in the South, such programs are especially vital to the region. Texas, which hosts the second largest number of military bases in the US, offers grant and loan programs to communities support those that were positively affected by Department of Defense decisions, such as new or expanded military missions, or communities negatively affected, those recovering from a reduction or termination in defense contracts. The Georgia Military Zone Job Tax Program provides a $3,500 per job tax credit to businesses that create at least 2 new jobs in high-poverty census tracts adjacent to military installations. These incentives not only support those businesses that may employ families of service members, but also encourage economic development in and around defense communities.

Users can use the incentives database to identify regional trends, especially those that will be relevant to their own economic analyses. Please contact C2ER if you are interested in the data or if C2ER can help facilitate a regional analysis.